Integration Details

Payactiv is fully integrated with ADP Workforce Now Next Generation for a seamless, automatic experience. A business administrator can use single sign-on (SSO) to set up Payactiv, and their employees can enroll using their standard ADP credentials. With this integration, the system automatically syncs employee profiles and hours worked in real time, and seamlessly passes deduction information back to ADP at the end of every pay period, meaning zero extra administrative work for your team.

Applications Integrated

- ADP Workforce Now Next Generation

Integration Type

- 1. Bi-directional data exchange

2. Single Sign-On (SSO) )supported for both practitioners and employees

3. Buy Now

Application Type

- Data Connector & End User

Data Sync Frequency

- 1. Real-time for employee census data

2. Real-time or Scheduled (hourly) for time and attendance data

3. Scheduled (once a pay period) for payroll deductions

Data fields

- The following time and attendance fields will be read by Payactiv:

You must be using ADP Workforce Now Next Generation Essential Time for automated timesheet integration

Worker ID

Shift date/Entry date

Hours/Minutes worked

Pay code/Job code - The following PPI fields will be read by Payactiv:

First name

Last name

Employee ID

Employment Type (Salaried or Hourly)

Income rate (Hourly, Pay-period, Monthly, or Annual)

Hire date

Date of birth - The following payroll deduction fields will be sent from Payactiv to ADP:

Payroll Deduction Code

Associate OID

Amount of funds early-accessed, plus $5 fee when applicable

Commitment to Responsible AI

Together with ADP Marketplace, our company is committed to the responsible use of AI. When incorporating AI into our product(s), we have agreed to comply with ADP Marketplace’s AI principles focused on human oversight, monitoring, privacy, explainability, transparency, and mitigating bias. Learn more here.

How we use AI

- Payactiv leverages AI models to analyze trends data, which enhances the operational efficiency of our programs. Our AI agent (Liv) provides workforce insights based on EWA usage and other Payactiv services, with appropriate human oversight and privacy safeguards to support responsible decision-making. Our approach helps ensure that AI's capabilities are utilized responsibly and effectively to benefit our users.

• We employ AI to identify patterns and insights that inform decision-making processes, without utilizing personal or user-level data.

• Our AI systems operate under strict human oversight, with audit and risk assessments to ensure they function as intended.

• All recommendations generated by our AI models are intended for human decision-makers, ensuring that the final decisions are made by people, not machines.

• We continuously monitor and test our AI models to maintain their performance and mitigate any potential biases. - If you have questions about how Payactiv uses AI, please contact us.

Earned Wage Access

Employees can access up to $500 of already earned wages in real time. Funds are transferred to the employee's bank or card, or are picked up as cash from a Walmart Money Center. In addition, earned wages can be used to access Uber, Amazon, or Pay Bills directly from the Payactiv app.

We Front the Funds

- The money taken by employees using Payactiv is deducted from upcoming paychecks when payroll is processed—just like any other deduction. There is no change to payroll and associated taxes.

Transfer to any Bank or Card

- Users can transfer funds in real-time to a card or via ACH to their bank.

- No change is required to their banking information.

- ADP Card Load - If you are currently making ADP pay cards available to your employees, they can transfer funds in real time. Real-time means real-time.

Access for the Underbanked and Underserved

- Use Uber anytime from the Payactiv app; no credit cards or Uber account is required.

- Load funds on an Amazon gift card, no additional cost.

- Pick up as cash from the nearest Walmart Money Center.

- Users can pay bills directly from the Payactiv app.

Tips & Mileage

Replace the outdated manual calculations, delays, and hassle of having enough cash on hand to disburse your employees' tips and mileage with the Tips & Mileage feature. Service industry employees rely on more than half of their income to come from tips. We can help you automate electronic disbursements of employees' tips directly to a Wisely card, existing debit card, or bank account. You can eliminate the need to keep large amounts of cash on hand and rest easy with a 2-day cash float.

Happier Employees with Better Tips

- Reduce errors related to manual processing of tips

- Works with your existing POS system, no disruption to your business

- Increase cash flow with Payactiv's 2-day cash float

- Give your employees better access to their tips

- Eliminate trips to the bank and armored car deliveries

- Save time on processing and disbursing daily tips

Saving and Budgeting

Empower your employees on their journey to financial growth with our smart saving and budgeting tools. We help make saving a reality by empowering users to set attainable goals based on real-time data about their spending habits and income patterns.

Goal-Based Saving

- Allocate saving for upcoming expenses or saving goals

- Get an assessment on how much is safe to save each pay period

- Create custom saving goals

- Save automatically from your paycheck each pay period

SmartSave

- Payactiv helps to estimate how much is safe to save each pay period by looking at the individual’s income and spending habits in the bank account or cards they linked within the Payactiv app. The data is more accurate when the user links their primary account numbers, which they use most often for their expenses.

SmartSpend

- Similar to SmartSave, SmartSpend helps to determine how much is safe to access from earned wages based on the information collected about the users’ income, spending habits, and any saving plans. The data is more accurate when the user links their primary account numbers that they use most often for their expenses.

Financial Counseling

Unlimited access to appointment-based 1-1 counseling with trained financial coaches. Users can also access self-paced financial learning resources integrated through the mobile app and website to help make informed financial choices at no cost.

Budgeting and Saving Strategies

- Helping employees improve their budgeting skills and saving strategies

Credit Building

- Aiding employees in understanding their credit, improving their credit and increasing their credit scores.

Debt Resolution

- Counseling employees to understand their options to reduce and pay off debt-from debt management to debt settlement and bankruptcy.

Discounts

Payactiv users can save up to 85% on their prescriptions by entering their prescription name and comparing prices from multiple pharmacies in their area. Find the best deal and save the coupon in the app. Show the coupon to your pharmacist and save on your prescription.

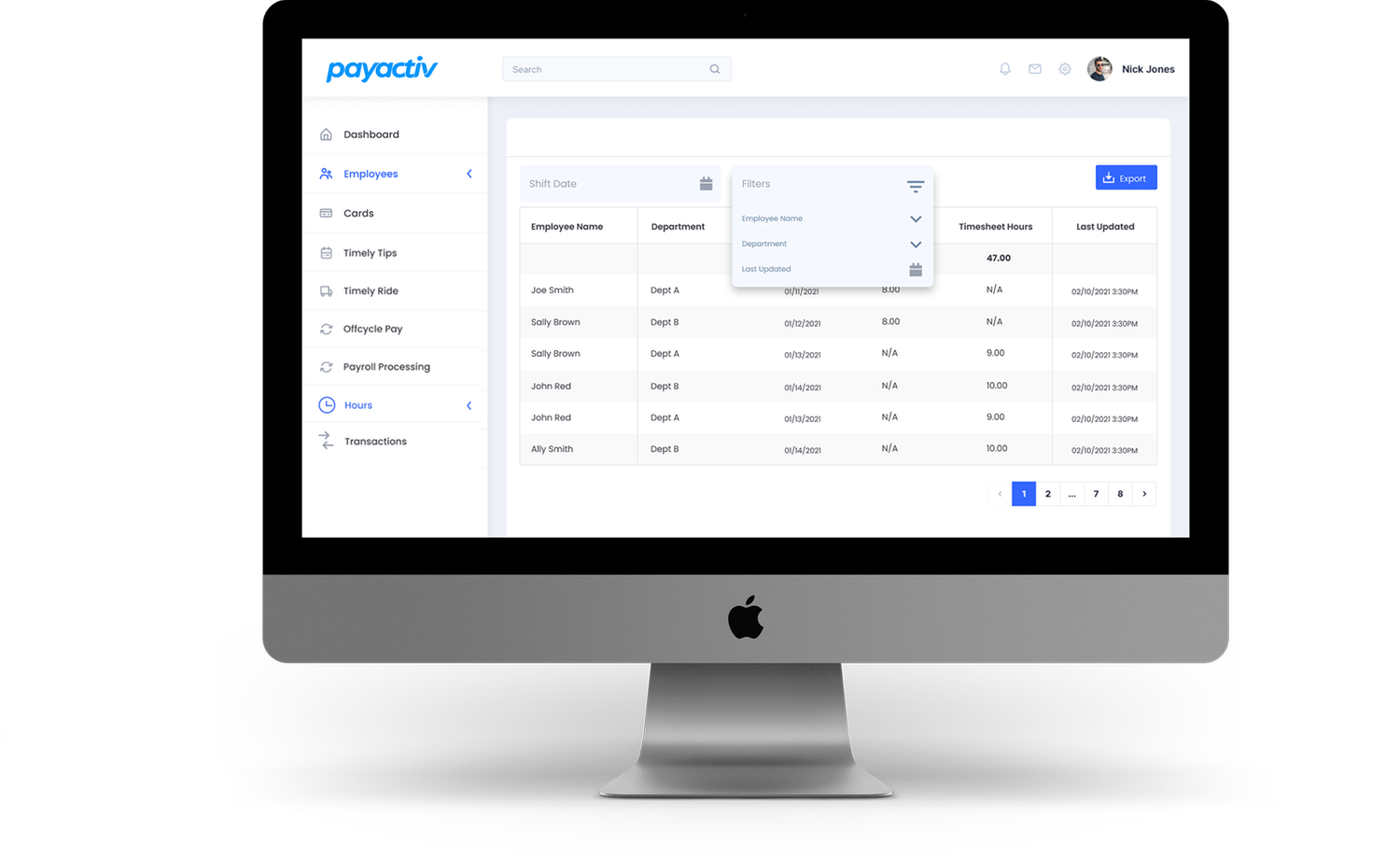

Employer Portal

An easy-to-manage online portal provides everything needed for HR and payroll managers to manage the financial growth services and monitor the adoption and engagement with their workforce.

Manage Users

- Sign up new employees, look up needed information, make updates, and deactivate users.

Administer Services

- Issue payroll cards and off-cycle payments, manage tips and awards, offer shifts and more.

View Transaction History

- Review EWA activity and disbursed payments like tips/mileage and off-cycle pay.

Track Progress

- Track adoption rates for implemented services and measure success for your organization.

AI Agent for Workforce Insight Queries

With Payactiv’s AI agent, Liv, users can ask natural-language questions to retrieve insights based on EWA usage and other Payactiv services, including trends over time and high-level workforce signals.